With the uncertainty in August behind us, the markets are back in their glory this September, and the (W)right way to get a flavor of the trending market is the Wright Momentum portfolio!

So here’s a refresher on the Momentum portfolio to get you started!

Take advantage of the trending market. A momentum strategy is specifically built to take advantage of the bull market. Momentum works when people herd towards stocks (due to structural reasons), and high momentum stocks emerge as bull market winners.

In the continuing bull market, our Momentum strategy has given 90% returns in 10 months which is 50% better than the Nifty.

Why Momentum and How? - Momentum is a behavioral factor. A momentum-based investing approach can confuse investors who are often told that chasing performance is a mistake and it is impossible to time the markets.

Yet as a systematic factor, it sits on decades of outperformance. At Wright Research, we look at multiple momentum and breakout signals to create this portfolio focusing on diversification and keeping risks low.

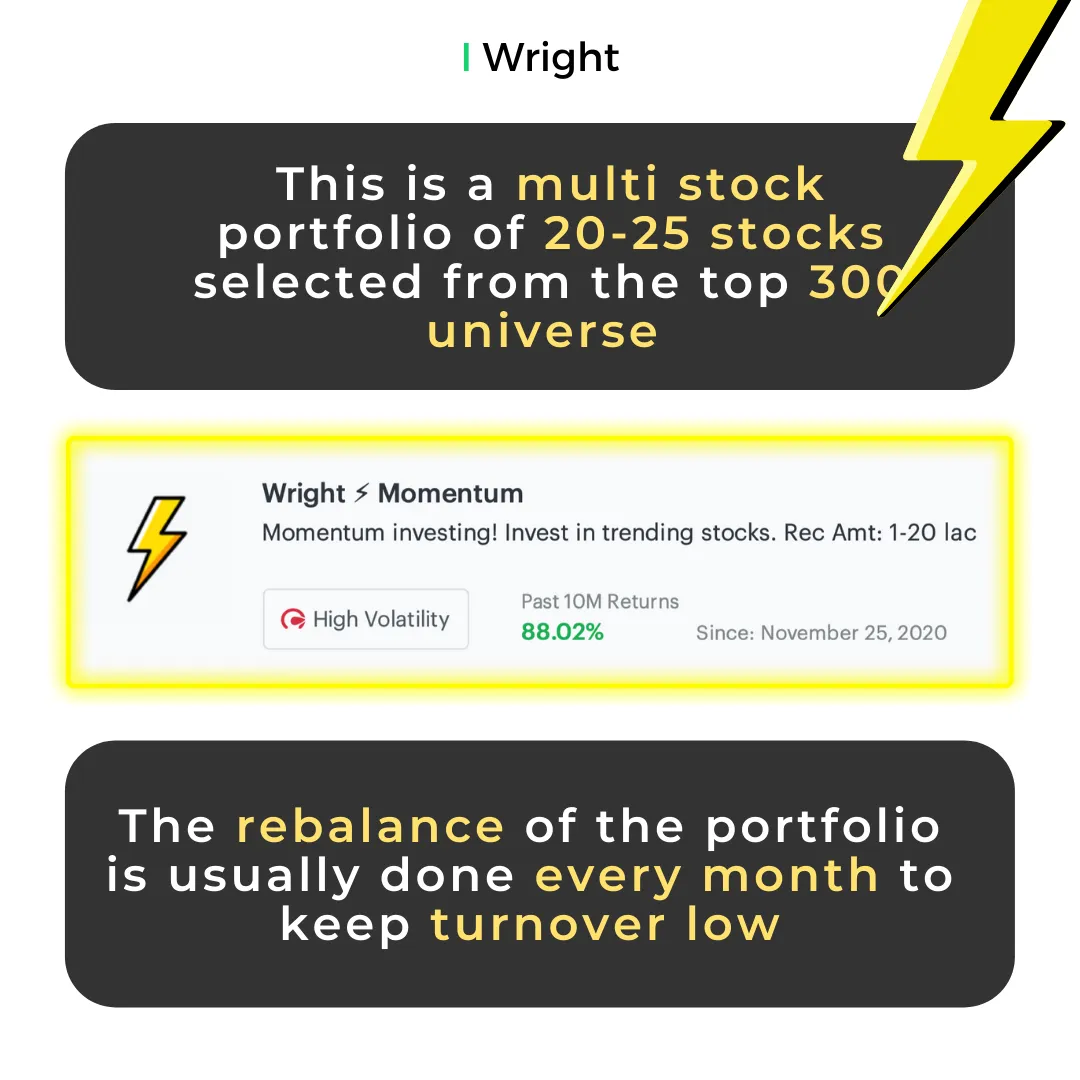

Where do you invest? A momentum strategy is sector agnostic and dynamic. We invest in cyclical sectors when markets are in the growth phase and defensives when markets are consolidating. We have a smallcap bias when smaller stocks are in flavor but switch to bigger stocks otherwise.

Even then, we keep the turnover very low by rebalancing monthly and changing only 0-4 stocks per month.

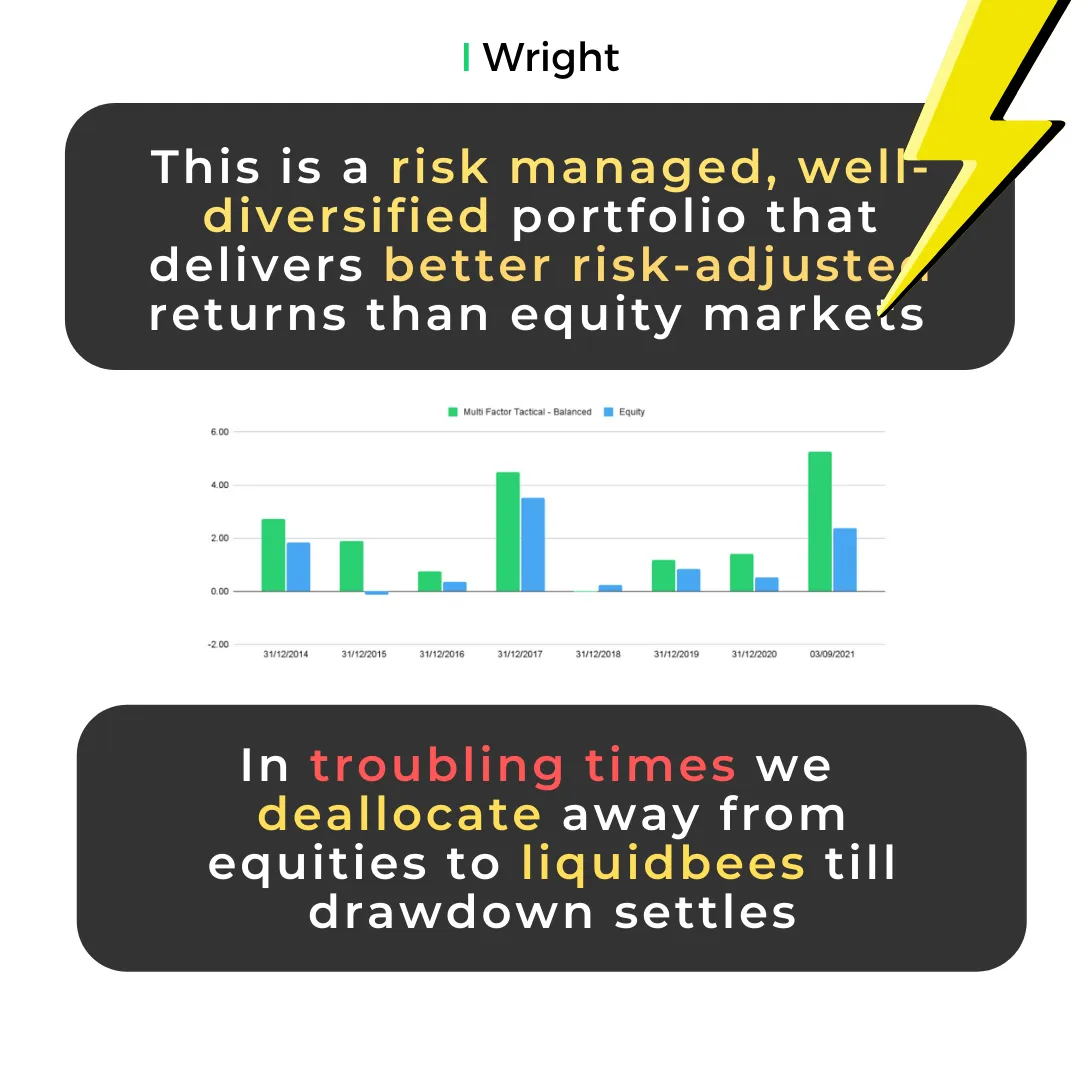

Wright Momentum has a robust risk management policy. As a result, the portfolio is generally well-diversified.

In difficult times, we have a deallocation policy. For example, we systematically shift money away from equities to safer liquid bees in drawdown times for equity markets until the drawdown settles.

Wright Momentum

Wright Momentum is the most loved and trusted portfolio by Wright Research.

The portfolio has delivered 87% returns in 10 months at a 50% outperformance over Nifty and you can get started with only ~ 35,000 Rs at a monthly fee of Rs 200 + GST

Use coupon code 2YEARS for 30% discount till Sep end.

Wright ⚡️ Momentum smallcase by Wright Research

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart