Momentum is one the most debated yet the most popular factor influencing equity market returns. Momentum is defined as the strong predictive power of past returns in influencing future returns. In its simplest form one looks at the past returns of the instrument as the signal influencing future returns.

A momentum-based investing approach can be confusingto investors who are often told that chasing performance is a mistake and it is impossible to time the markets. Yet as a systematic strategy, momentum sits upon nearly a quarter century of positive academic evidence and a century of successful empirical results. The momentum anomaly is difficult to explain with the efficient market hypothesis, where price change is warranted only by changes in demand and supply or new information. Momentum finds a basis in behavioural finance attributing it to various cognitive biases in irrational investors like herding behaviour, confirmation bias, initial under-reaction and delayed overreaction.

In a paper I co-authored at qplum on Momentum in the Indian Equity Markets: Positive Convexity and Positive Alpha we did a deep dive into the factor.

Seeing the encouraging performance of this factor in equity market returns recently, Wright is launching a Momentum basket as a free for all research product for the time being.

There are various ways is which one can construct a momentum portfolio. The most popular being just looking at the past one year returns and picking the top stocks. One can also adjust the previous returns with the risk. There are certain more nuanced technical indicators like Bollinger Band breakouts, Relative Strength Index, etc that are also used.

Our methodology is a combination of a few of the momentum factors along with a big focus on keeping the risks low.

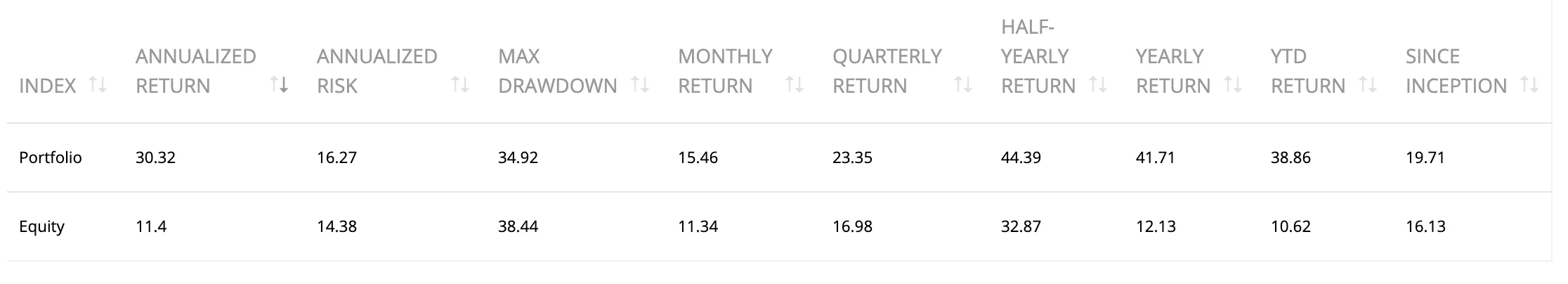

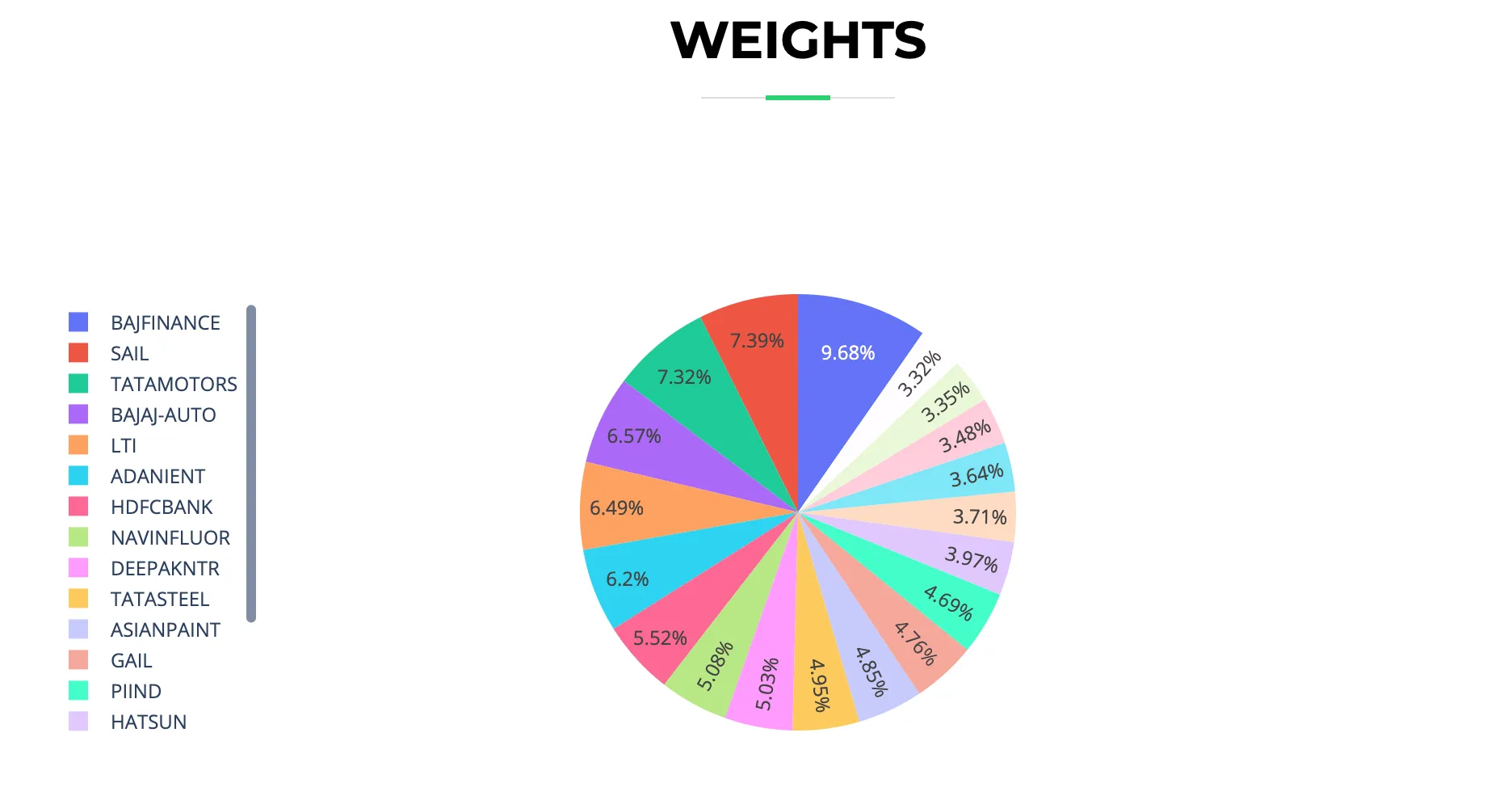

We try to size our positions such that no single stock gets more than 10% allocation. We put a limit on sector and industry allocations as well to promote diversification. The position sizing is done using the mean variance optimisation methodology.

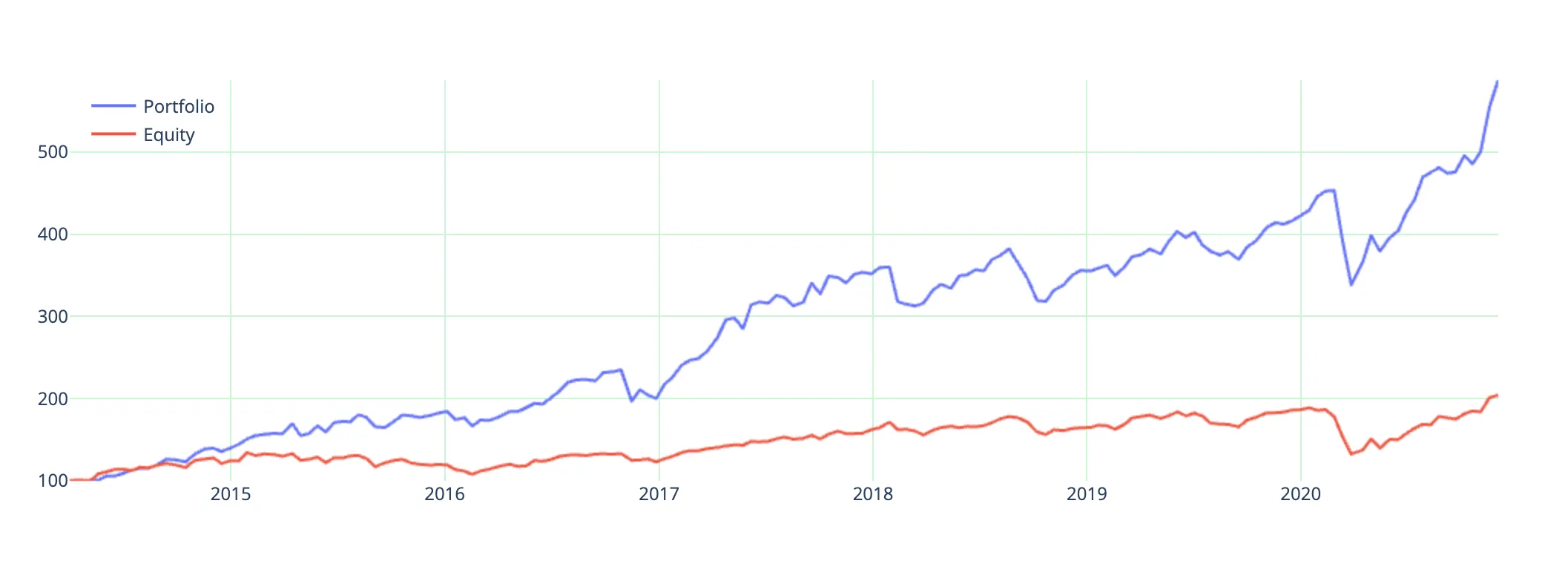

Here is the historical performance of the portfolio based on the backtest

You can find this portfolio on smallcase here: https://wrightresearch.smallcase.com/smallcase/WRTNM_0001

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart