Your favourite quant advisor is back up and open for business. Now as a corporate SEBI registered investment advisor! So if you have been waiting to start your subscription with us, now is the time!

Here’s a snapshot of Wright products:

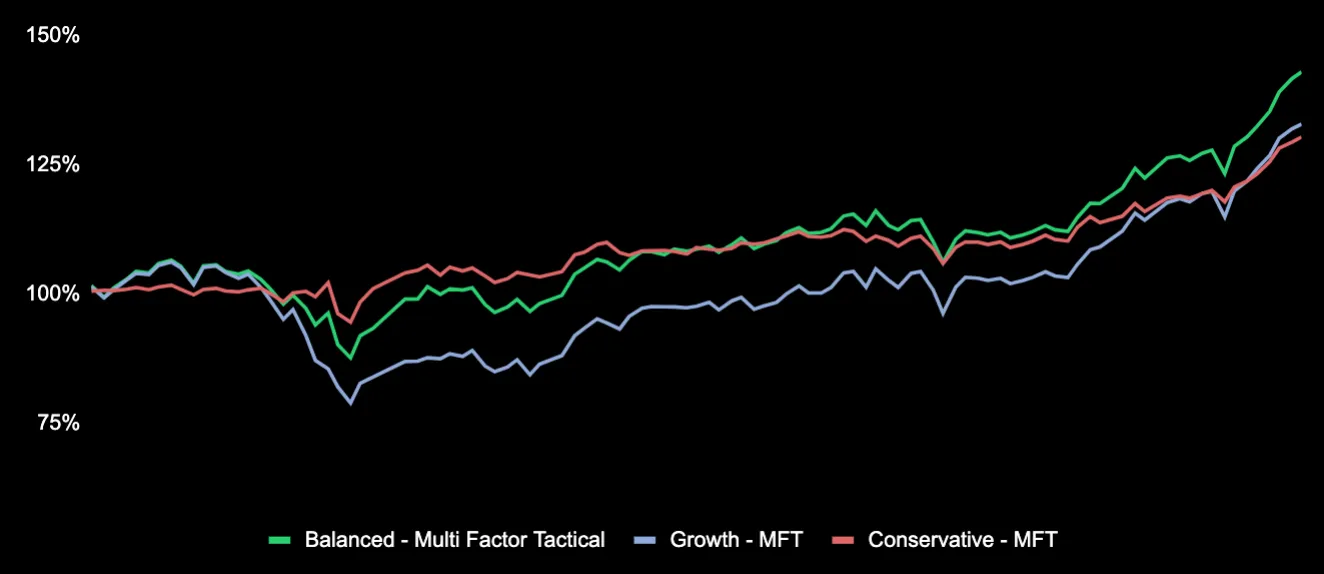

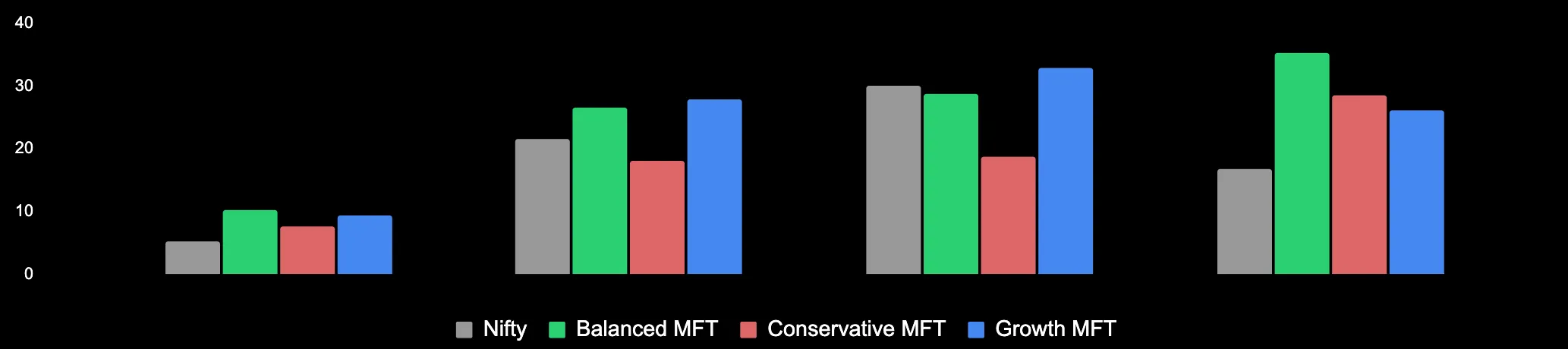

These are the core of the quant portfolio offerings of Wright. These are unique portfolios that tactically invest in multiple factors in the market, notably momentum, growth, low-volatility & quality. We allocate to the best factor for any market regime for best performance.

We also have a strong predictive market regime model based on economic & technical factors that signals when it’s a time to deallocate away from equities. This keeps the risk & the drawdowns low.

We offer these portfolios in 3 risk profiles — Balanced, Growth & Conservative.

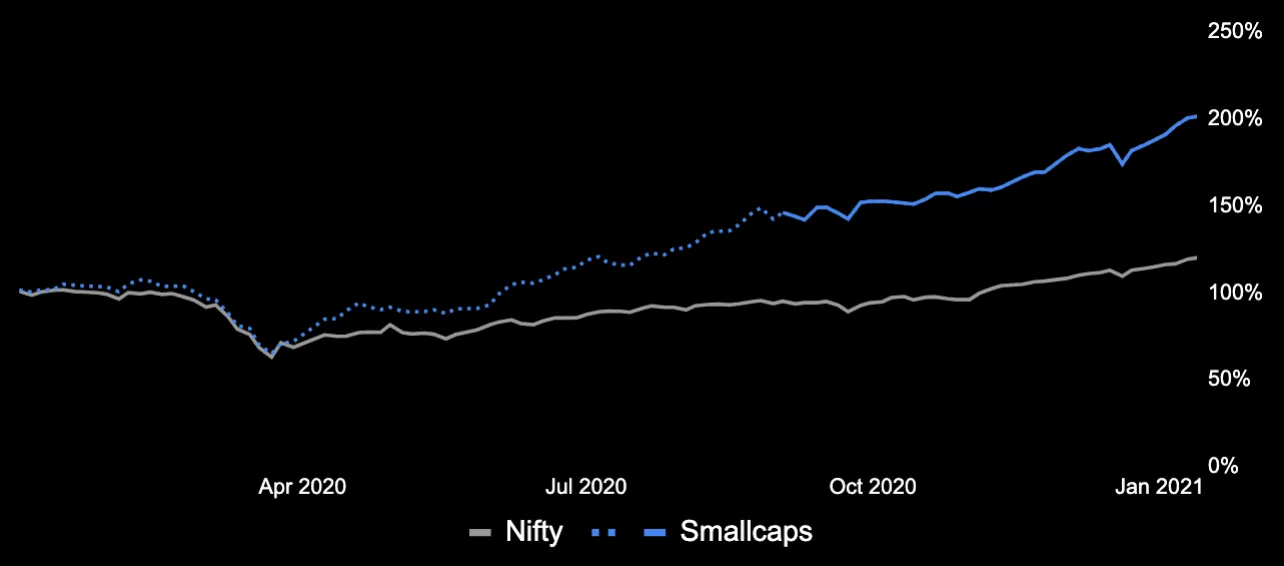

These are quant based smallcaps portfolios. As the name says, we pick up smallcaps in this portfolio based on various pertinent factor like — momentum, quality, value, growth etc. We use a quantamental machine learning based model for our position sizing.

This portfolio has been live for close to 6 months and has had a spectacular run while the smallcaps have been having a good run post April 2020.

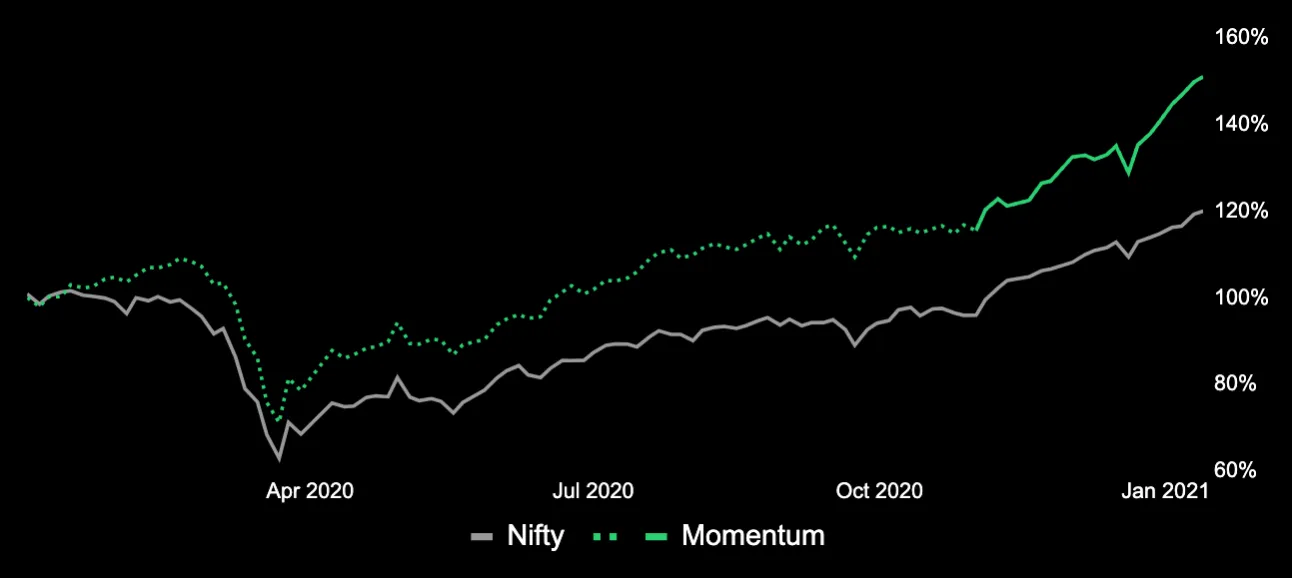

This is a trend following portfolio where we use a few momentum signals like previous period returns and stocks crossing all time highs, while being careful with the risk across market caps to deliver high returns.

This portfolio has been live for close to 3 months and has already delivered 25%+ returns in the bull run that the equity markets are having.

Do check out these portfolios on smallcase.

Also, signup for our monthly newsletters to keep posted about what Wright is doing!

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart