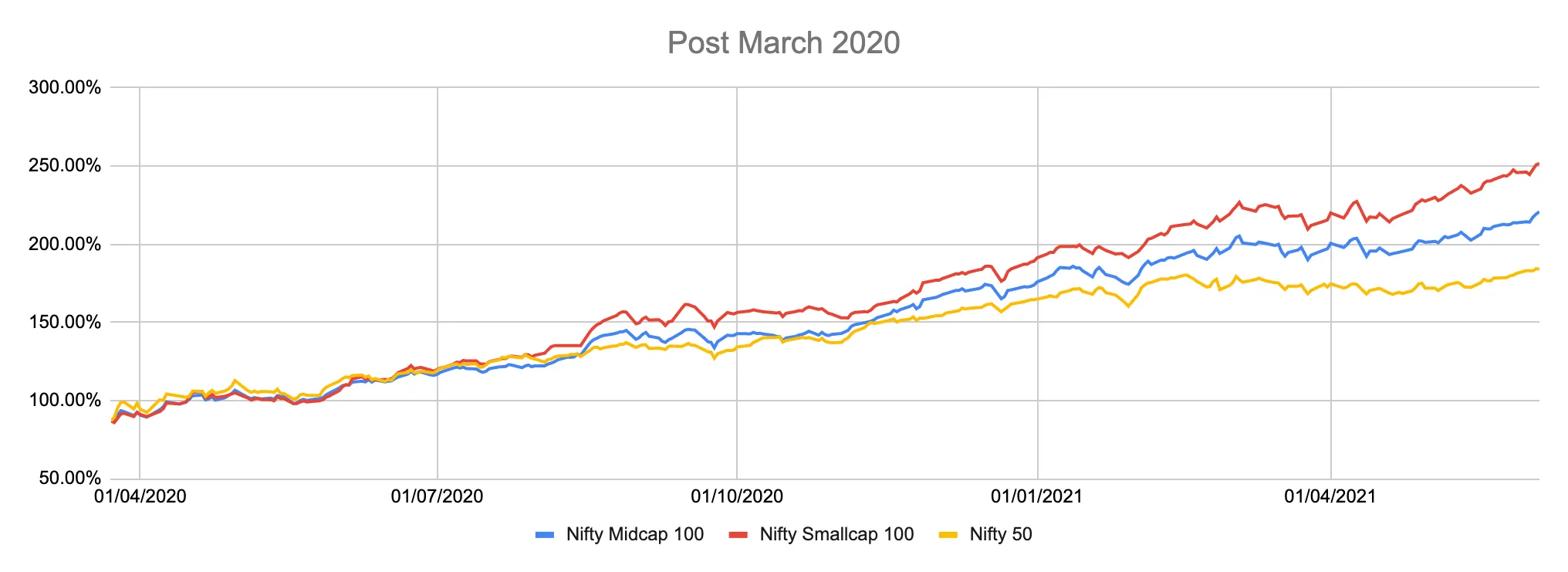

Have you noticed that smallcaps have been on the rise and they've been skyrocketing! The smallcap stocks on the whole have outperformed the mid caps and large caps in a big way. In the chart below, showing equity returns since April 2020, smallcap index has almost given a 150% return.

What is the reason for this rise?

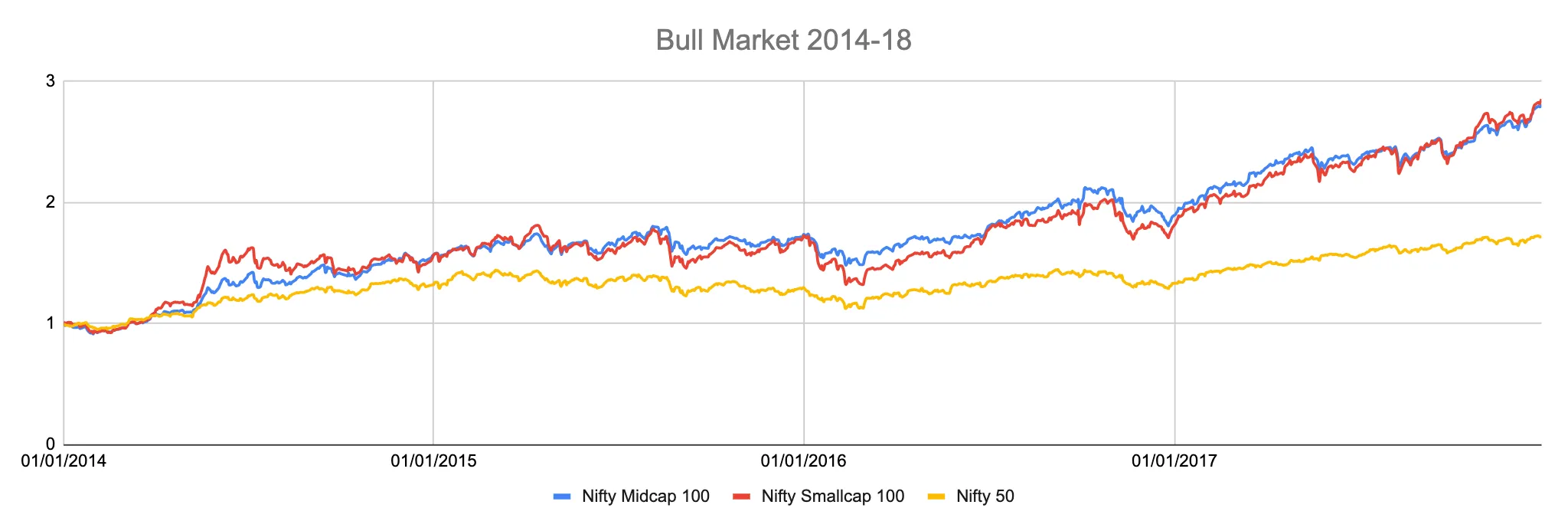

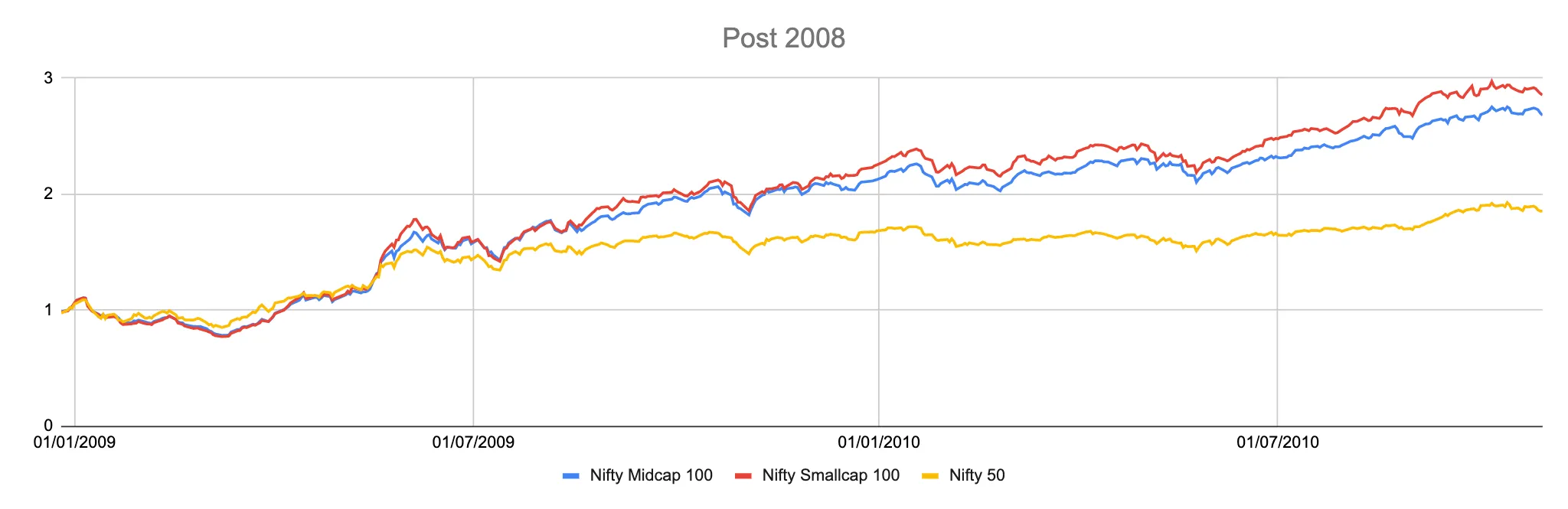

Smaller stocks are considered to be more in sync with the economy, when there is growth in the economy small caps rise at a rapid pace. If you look at the historical trends in the Indian markets, during bull phases, small caps have outperformed larger stocks.

Here are charts from the two recent bull markets,

It's easy to notice that smallcaps outperform larger stocks in bull markets!

Why are smallcaps outperforming now?

Risks associated with Smallcaps

Small-cap companies tend to beriskier investmentsthan large-cap companies. If you pick an emerging stock there is greater growth potential and it would tend to offer better returns over the long-term, but these stocks do not have the resources of large-cap companies, making them more vulnerable to negative events and bearish sentiments. Smallcaps havehigher volatilityand are awarded with higher returns due to their nimbleness but during economic contractions, they suffer more than large caps.

What's next for smallcaps?

Thegrowth story of small caps is linked to the economic growth story. We are expecting a period of growth in the equity markets for the next 2-3 years at least, with high GDP projections & policy environment promoting growth, this would be a good growth environment for smallcaps and we expect the trend to continue in the near future.

Easy way to invest in smallcaps

To pick up a smallcap winner one needs to pick up emerging companies that have a big growth potential and also have a sense of momentum & volatility in the markets. We at Wright Research offer "Wright ❤️ Smallcap" portfolio that uses a mix of fundamental and technical factors to pick winners for the smallcap rally.

This portfolio has given amazing returns in the period of 8 months when it has been live and historical analysis show that this has a great outperformance potential. It is also closely managed for risk with systematic deallocation procedure in place and can be a good way for people to get a flavour of the juicy smallcap returns.

You can checkout Wright Research’s very own smallcap smallcase here:

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart