by Sonam Srivastava

Published On Sept. 17, 2022

There is recurring doubt among investors that Momentum might not be a strategy suited for the long term as it is trying to capture short-term trends. But if you look at the data, you’ll find that Momentum is, in fact, an excellent strategy for the long term.

Momentum trading is often called the buy high, sell higher technique. A Momentum investor is not directly betting on fundamental value change but on the consensus formation about the upswing in a given sector or industry.

While a Momentum investor is looking at technical signals, the horizon of these signals can be distinctly large when betting for the long term. And momentum can prove to be an excellent strategy for the long term as:

It will give you distinctly high performance during bull markets

During volatile markets, it will dynamically adapt to the changing market conditions and switch over to safer sectors

Momentum strategy will always give you the flavour for the stocks and sectors shining at any given time.

Let’s study the performance of the Momentum strategy in various scenarios.

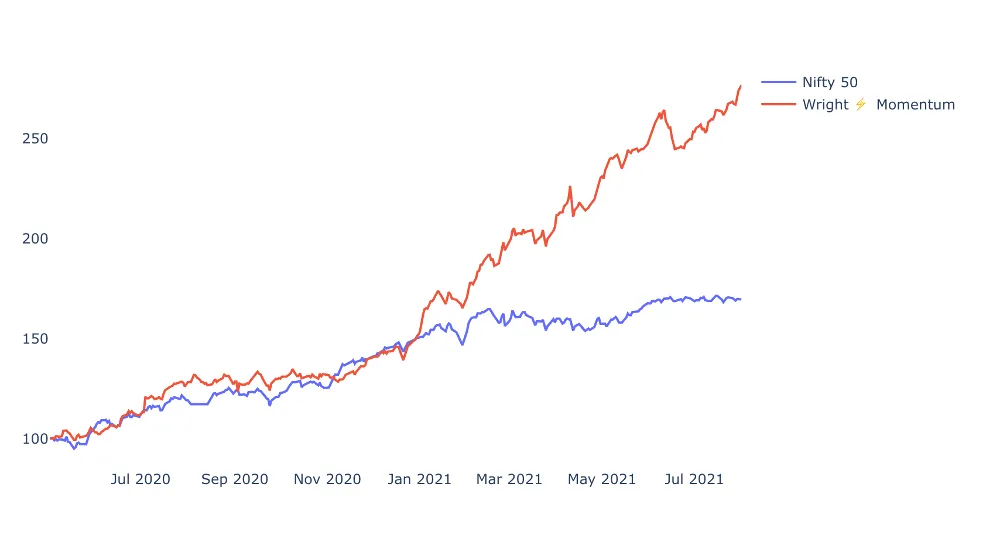

Bull markets are the best times to bet on momentum. So here we look at the performance of Momentum vs the Nifty index from May 2020 to Sep 2021. You’ll see the massive outperformance that Momentum has given concerning the index. While the index gave 69% returns, momentum gave a whopping 177% returns, which is a lot to its long-term dominance.

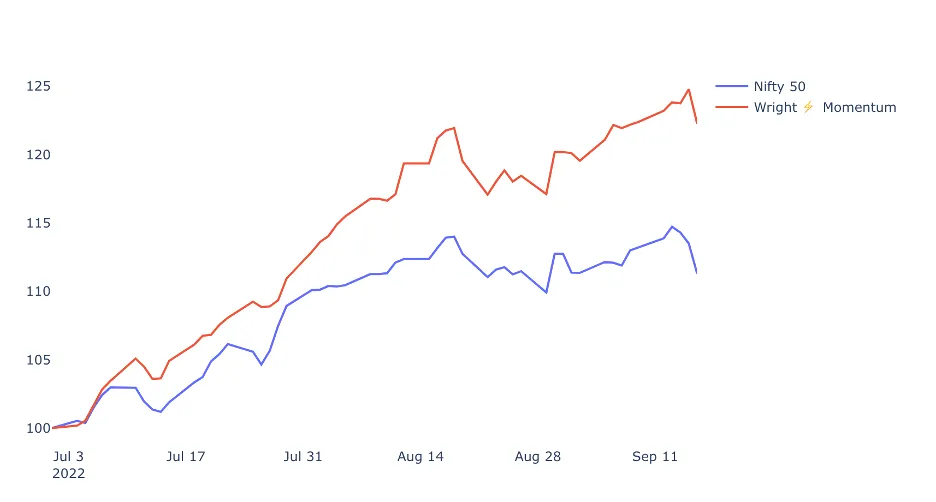

In volatile times like last year, you’ll see that Momentum would reflect the risk in the market. Still, even in such volatile times, you can see Momentum giving a minor outperformance over the market due to its dynamic nature.

During market crashes, Momentum is also in trouble. To counter this, risk management in the strategy comes into play. We deallocate some parts of the portfolio to cash and reduce portfolio risk, which leads to a lower drawdown than the market.

In the last three months, Momentum has given a 27% return which is no less than a dream run! This is a classic case of market recovery and momentum taking over. What is more interesting is that the momentum portfolio now is not betting on risk-prone sectors but relatively low volatile sectors.

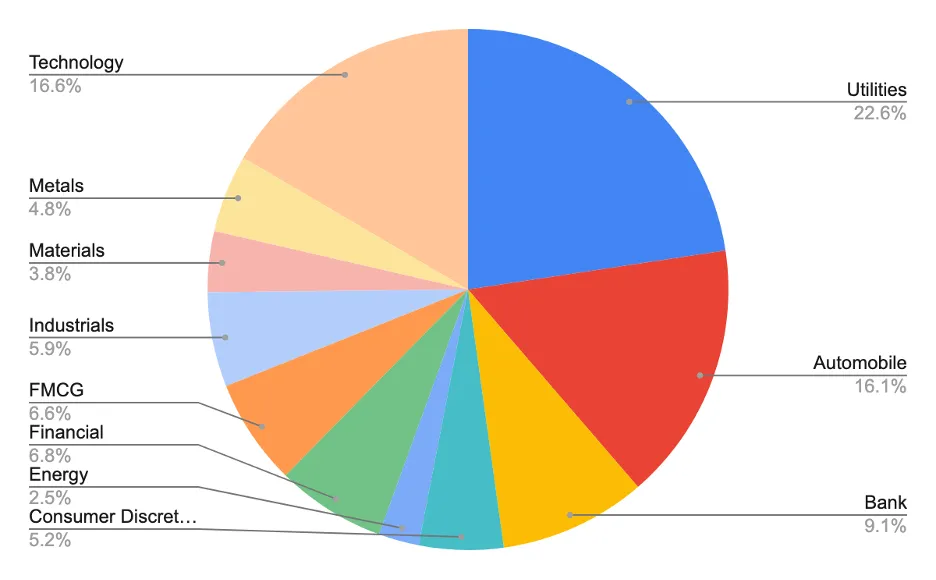

We can see that the momentum strategy has switched from technology and is betting on Autos, Banks and Consumer stocks. In addition, due to the bearish sentiment in the past year, we see the Utility sector also getting allocations in the Momentum strategy.

The market might see short-term volatility, given that the global markets have been in turmoil since the US inflation numbers came out. In addition, there is an expectation for another rate hike of 75 bps by the US FED, taking the rates to levels we haven’t seen since 2008. There is ample cause for concern in the short term troubling the market. Still, in a long time, we expect India to remain attractive, backed by solid growth momentum and reasonable valuation.

The IT sector has been battered since the inflation numbers came out in the US. As the Indian IT industry caters mainly to the US technology companies, Nifty IT has fallen in sync with the US market, while the pain hasn’t been as acute for other sectors.

The auto sector has become a favourite of the market. The declining raw material and fuel prices, strong domestic demand, and the festive season rush make the industry attractive, as the prices show. If the market offers a significant short-term correction, it would be an excellent opportunity to accumulate auto stocks which are becoming expensive.

Check out Wright Momentum

Wright ⚡️ Momentum smallcase by Wright Research

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart