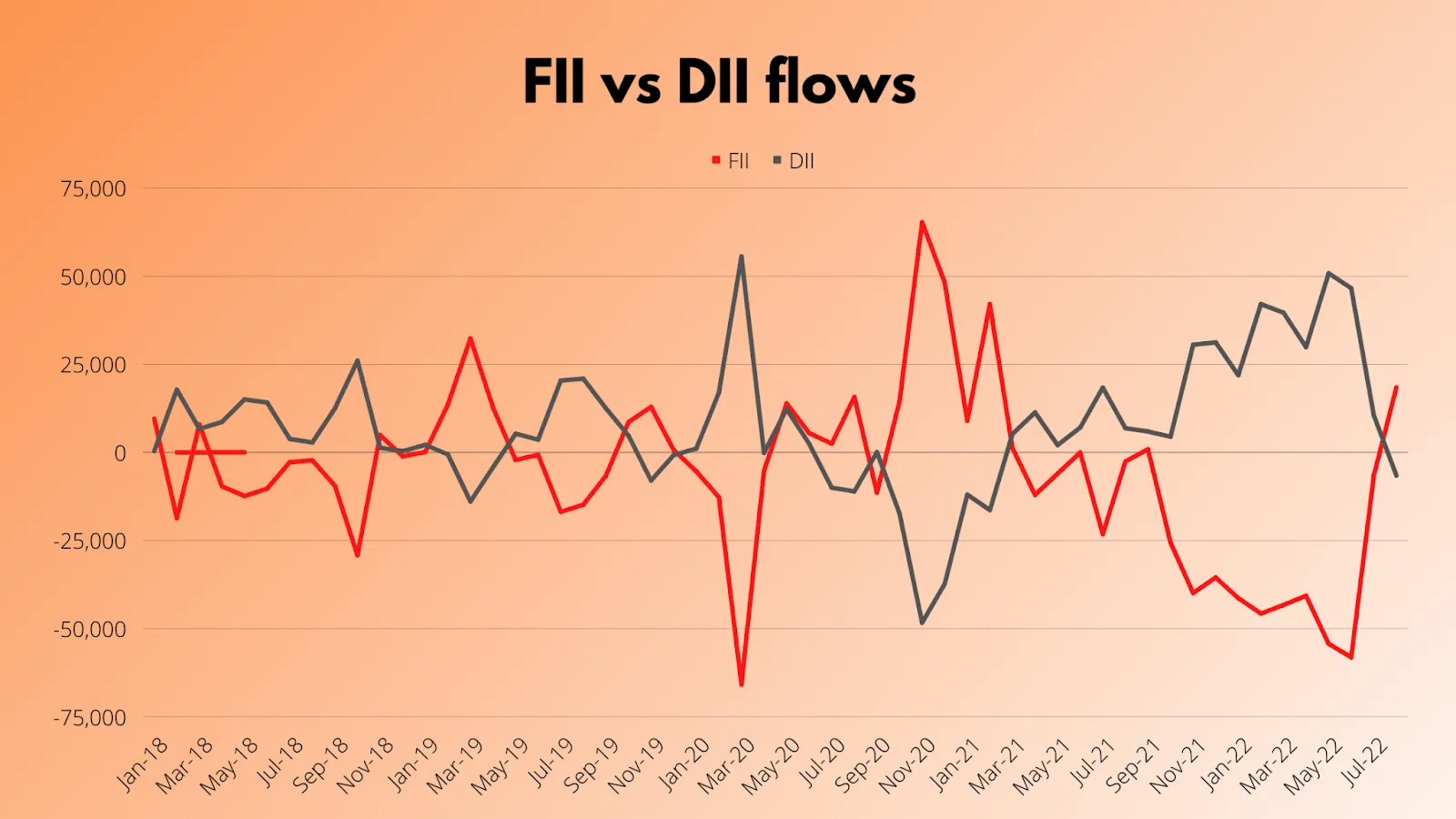

After months of constant selling from October 2021 to June 2022, foreign institutional investors (FII), who withdrew more than $30 billion from Indian equities, returned in July. It seems that FIIs are back in love with Indian markets and, to date, have purchased shares worth $ 5 billion. So is it fear of missing out, or is it something else?

India had the most FII sales for her this year, but that trend suddenly reversed in July. When DII buying stopped, FII returned to the market to buy.

In July 2022, the Emerging Markets (EM) Funds significantly increased their allocation to India (19.7% from 18.1% in June 2022) and significantly decreased their share to China ( 36.2% compared to 39.4%). The rationale might be improved growth prospects for India among key emerging markets. India has one of the highest projected GDP growth rates for next year, coupled with lower commodity and oil prices. With relative rupee outperformance, we see a positive outlook for the Indian market.

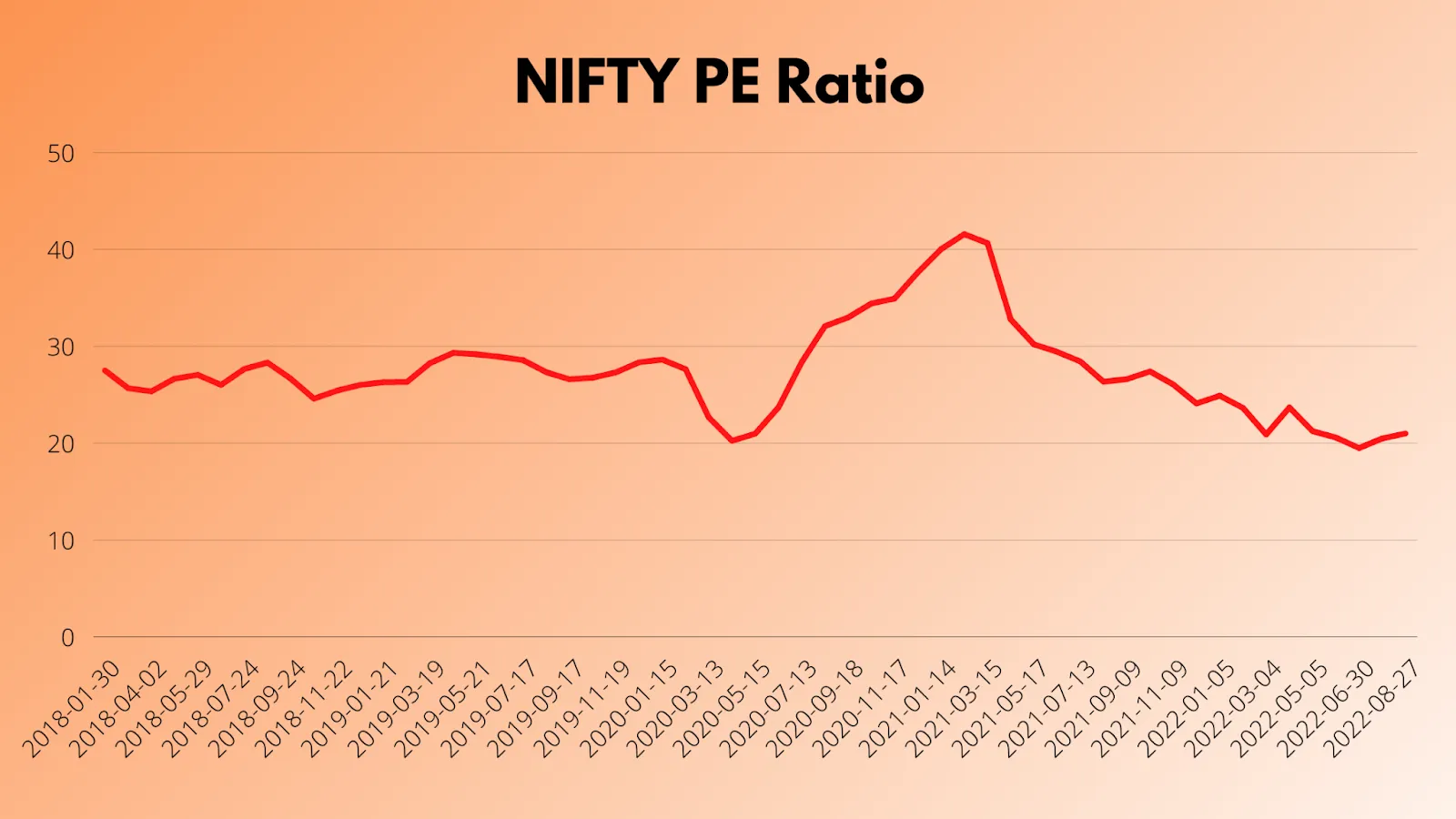

The reversal in FII flows in July could also be driven by attractive valuations in Indian equities. Nifty is currently trading at about 18x expected earnings over the year, compared to its long-term average of 21x. Moreover, FIIs have been reluctant to lose exposure to Indian equities when the global economy is recovering against a possible slowdown in inflation.

Foreign institutional investors play a vital role in any economy. Large companies such as investment banks, mutual funds, etc., invest large sums of money in the Indian market. With these big companies buying securities, the market tends to go up and vice versa. Hence, they strongly influence the total inflows of the economy.

FIIs are both triggers and catalysts for market performance, facilitating investment from all investor classes and other growing trends in financial markets in a self-organizing system.

FIIs are unlikely to buy aggressively if the dollar continues to be strong. The dollar index is above 108, and the US 10-year yield is 2.99%. This is a negative for capital inflows to emerging markets. India's impressive GDP growth and favorable leading indicators related to the global slowdown have the potential to attract more FII flows, but higher dollar and bond yields are strong headwinds.

The Fed chair repeated the tightening policy at a meeting in Jackson Hole. He said that high-interest rates would bring pain in the future. This could scare the influx of foreign investors.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart