by Sonam Srivastava

Published On June 10, 2021

As the subscribers are growing in our high risk high return momentum portfolio, there are increasing number of investor queries and concerns about what happens to these portfolios in the times of risk.

In this post we try to address your queries,

The momentum portfolio is composed of stocks that are trending. Investors herd towards trending stocks and that creates a lasting trend. But in bad times, investors quit these high valued trending stocks the quickest and a momentum portfolio is prone to as much drawdown as the market at bad times. Even though it may rise back up much more quickly than the market.

There is always momentum somewhere or the other in equity markets. Sometime cyclicals shine and other times defensives. Sometimes value works, other times growth. But there are those times like March 2020 when nothing seems to work.

At Wright Research we handle the risk in momentum investing using a methodology called systematic deallocation. What that means in simple words is that we reduce the stocks in the portfolio by selling a certain percentage and buying liquid ETF instead of that.

Our deallocation policy

It's quite simple.

Also, like all markets are not the same, similarly all drawdowns are not the same. A drawdown in a high risk environment is more lethal than one in a low risk environment. So we deallocate more aggressively when we see high risk.

How does that look in practise?

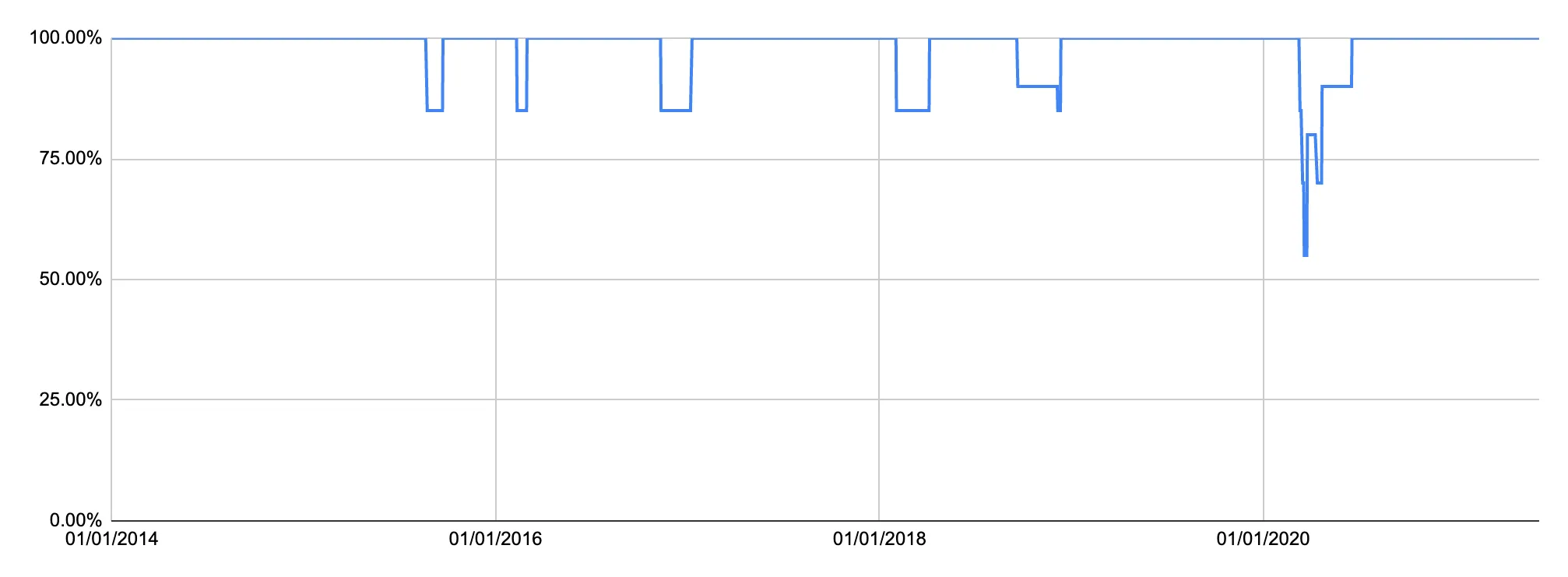

Since 2014, this is how our deallocation schedule would have kicked in. There are short periods in 2018-19 and the famous March 2020 crash where there would be deallocation.

How it affects the performance of momentum strategy?

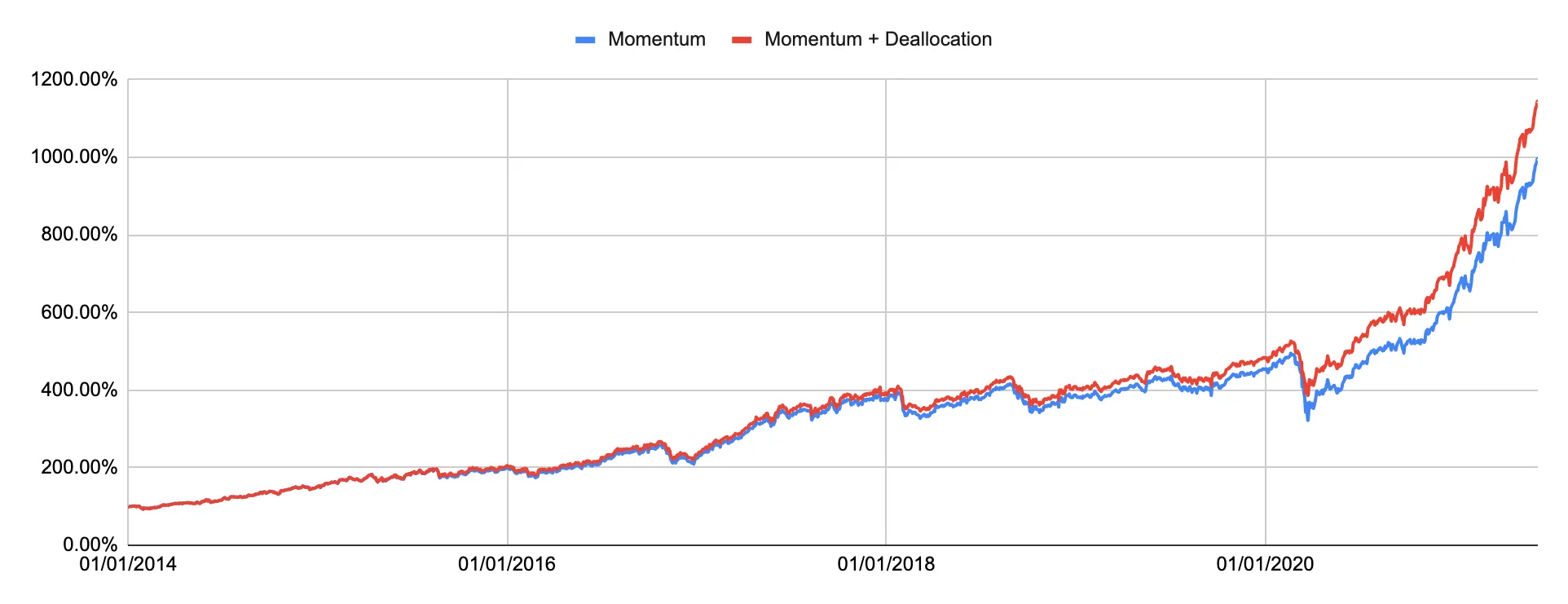

By a fair bit! Here's the performance of momentum portfolio before & after deallocation.

Systematic deallocation has

While we like to show you pure momentum returns in our backtested data, rest assured that we have a well defined methodology to reduce risk in times of trouble for the portfolio!

I hope this post gives you the reassurance that there are tight safeguards in place for bad times in your Wright momentum portfolio.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart